maine excise tax rates

This is the sticker price of the vehicle and its accessories. 2020 -- 1350 per 1000 of value.

In Maine beer vendors are responsible for paying a state excise tax of 035 per gallon plus Federal excise taxes for all beer sold.

. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. Boat Launch Season Pass - Piscataqua River Boat Basin.

The excise tax you pay goes to the construction and repair of roadways in. In Maine cigarettes are subject to a state excise tax of 200 per pack of 20. The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

YEAR 3 0135 mill rate. 4 rows Watercraft Excise Tax Payment Form - 2022. 2022 -- 2400 per 1000 of value.

WHAT IS EXCISE TAX. 2021 -- 1750 per 1000 of value. To calculate your estimated registration renewal cost you will need the following information.

The primary excise taxes on fuel in Maine are on gasoline though most states also tax other types of fuel. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Maine Cigarette Tax - 200 pack.

2018 -- 650 per 1000 of value. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Visit the Maine Revenue Service page for updated mil rates.

The operating plant and personal property used to produce and deliver communications services are assessed according to their just value at the municipal tax rate where the property is located. Tax Return Forms NOTE. Mil rate is the rate used to calculate excise tax.

For example a 4-year-old car with an MSRP of 22500 would pay 22500. 2017 Older -- 400 per 1000 of value. YEAR 1 0240 mill rate.

2721 - 2726. Sales Tax Medical Excise Tax Medical Max Medical Tax Sales Tax Recreational Excise Tax Recreational Max Recreational Tax. 2019 -- 1000 per 1000 of value.

YEAR 6 0040 mill rate. Contact 207283-3303 with any questions regarding the excise tax calculator. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

Excise Tax is an annual tax that must be paid when you are registering a vehicle. Maine Beer Tax - 035 gallon. 2022 Watercraft Excise Tax Payment Form.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Share this Page How much will it cost to renew my registration. How is the excise tax calculated.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. A state excise tax is assessed by MRS on businesses that provide interactive two-way communications for compensation in Maine. For example the owner of a three year old motor vehicle with an MSRP of.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. As of August 2014 mil rates are as follows. The tax rate is 25 for every 1000 of your vehicles value.

Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. 7 on-premise sales tax. How much is excise tax in Maine on a car.

Departments Treasury Motor Vehicles Excise Tax Calculator. 18 rows Commercial Forestry Excise Tax. Watercraft Excise Rate Chart.

The excise tax is calculated by multiplying the MSRP of the vehicle by the corresponding years mil rate shown below. Do NOT submit disks USB flash drives or any other form of electronic media. This calculator is for the renewal registrations of passenger vehicles only.

The rates drop back on January 1st of each year. 22500 X 0100 225. YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6 0040 mil rate.

For more information please see the Maine Revenue Services website or. Tax return forms and supporting documents must be filed electronically see Electronic Services or submitted on paper. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

How much will it cost to renew my registration. Maines general sales tax of 55 also applies to the purchase of beer. Maines Office of the Revisor of Statues explains that youll.

This information is courtesy of Larry Grant City of Brewer Maine. Maine Watercraft Excise Tax Law - Title 36 Chapter 112. Maine Aviation Fuel Tax In Maine Aviation Fuel is subject to a.

It is NOT necessarily what you paid for the vehicle. An excise tax needs to be paid within 30 days from the day its issued. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation.

The rates drop back on January 1st each year. Excise Tax is an annual tax that must be paid prior to registering a vehicle. Calculation will be based on.

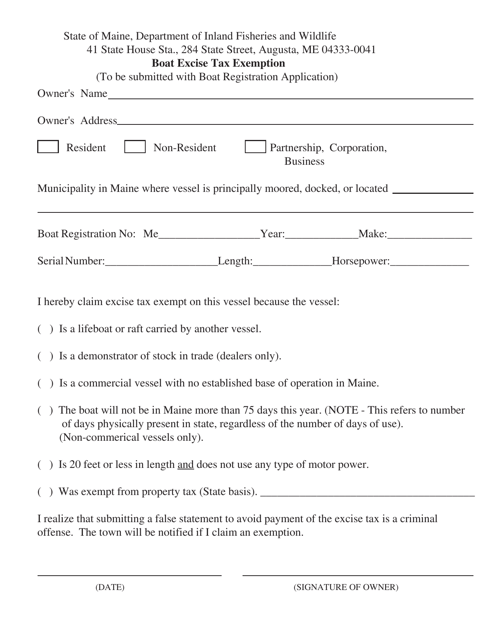

Maine Watercraft Excise Tax Requirement for Eliot Residents and Non-Residents. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. YEAR 5 0065 mill rate.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. For example a two year old car with a MSRP of 25000 would be charged a mil rate of 0175 totaling an excise bill of 43750 or 25000 x 0175 43750. YEAR 4 0100 mill rate.

Cigarettes are also subject to Maine sales tax of approximately 035 per pack which adds up to a total tax per pack of 235. 16 rows Effective July 1 2009 the full gasoline excise tax rate is imposed on internal. YEAR 2 0175 mill rate.

Watercraft Excise Tax Rate Table. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehiclePlease note this is only for estimation purposes the exact cost will be determined by the city when you register your vehicle.

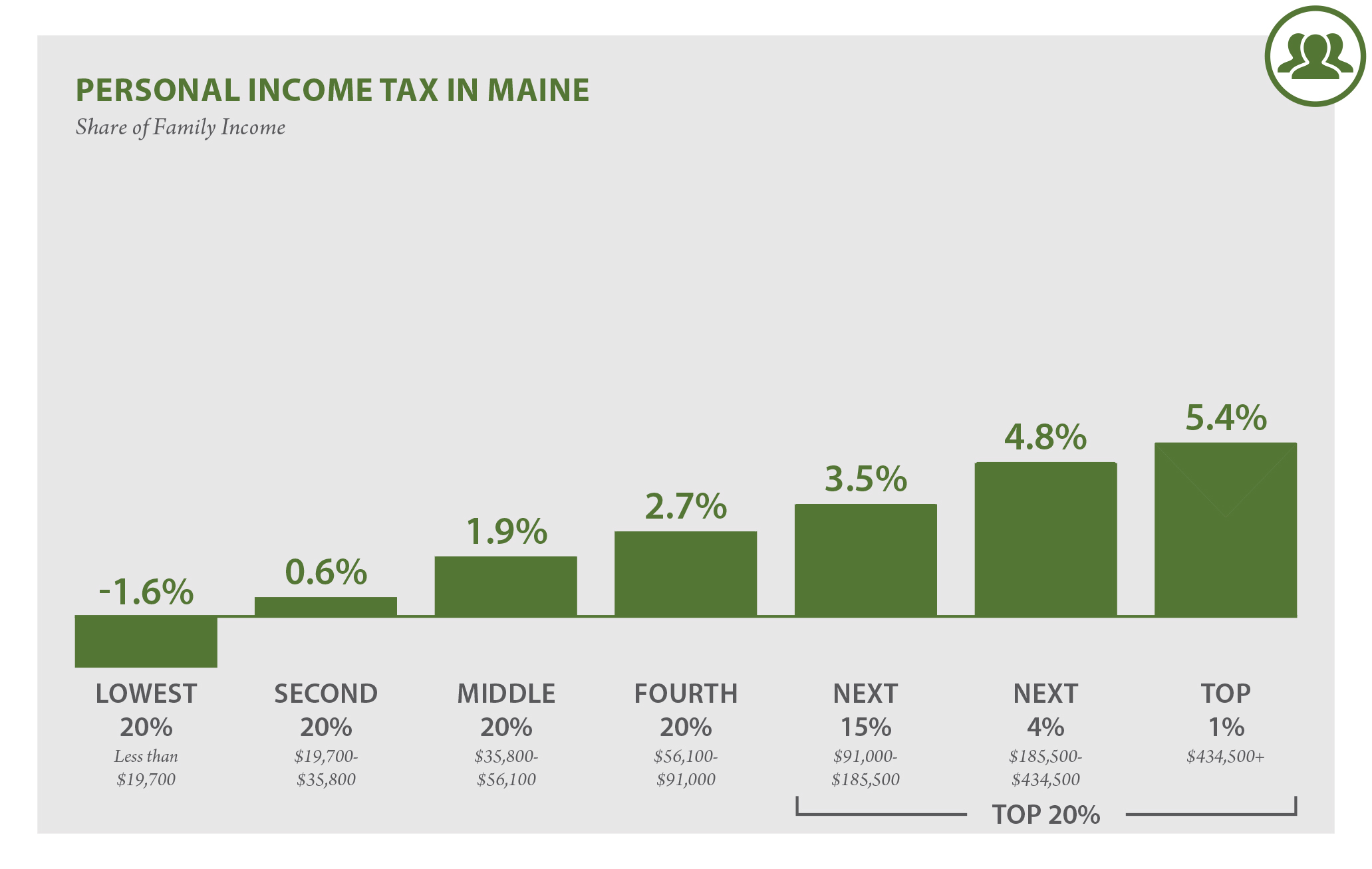

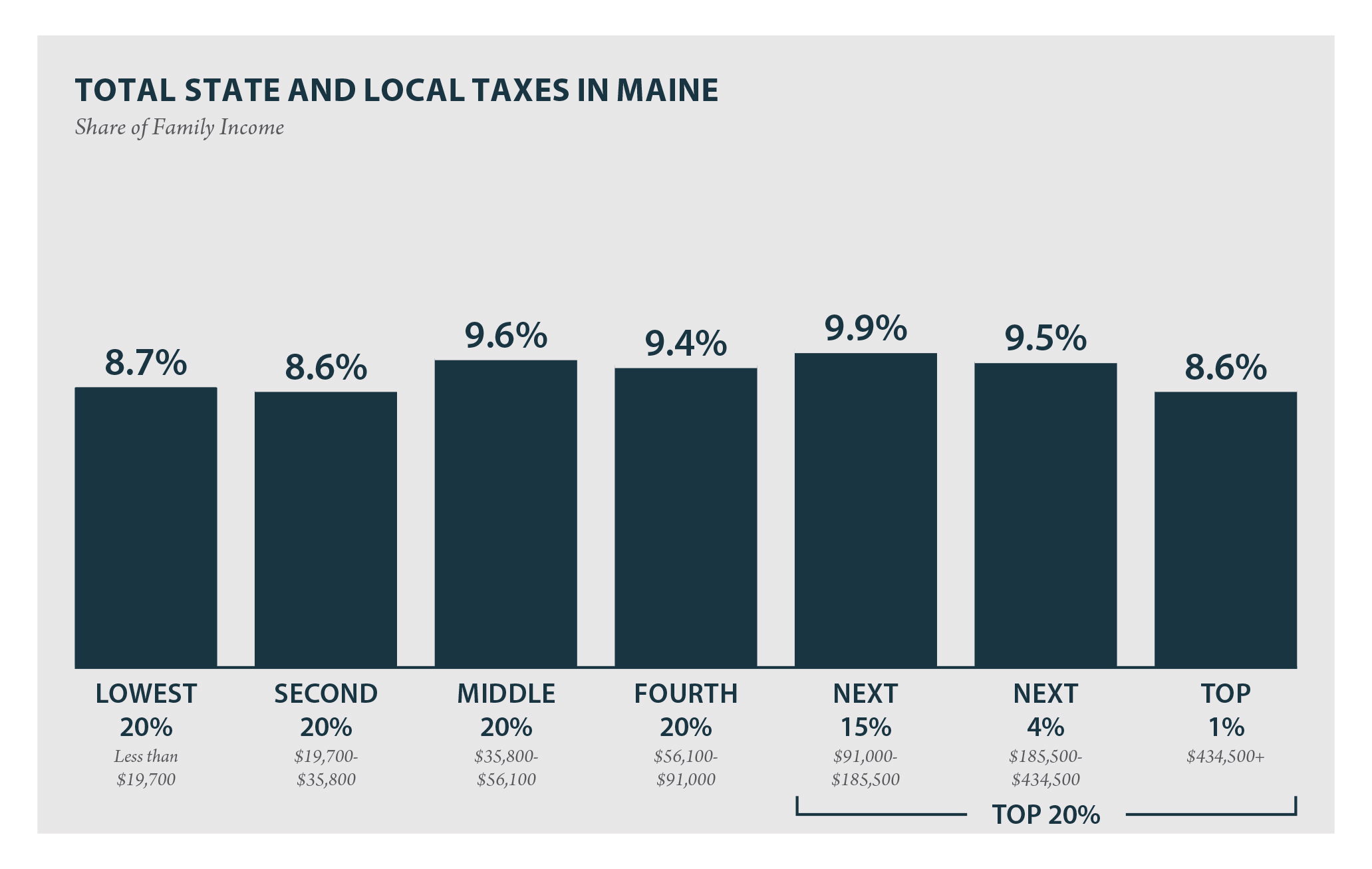

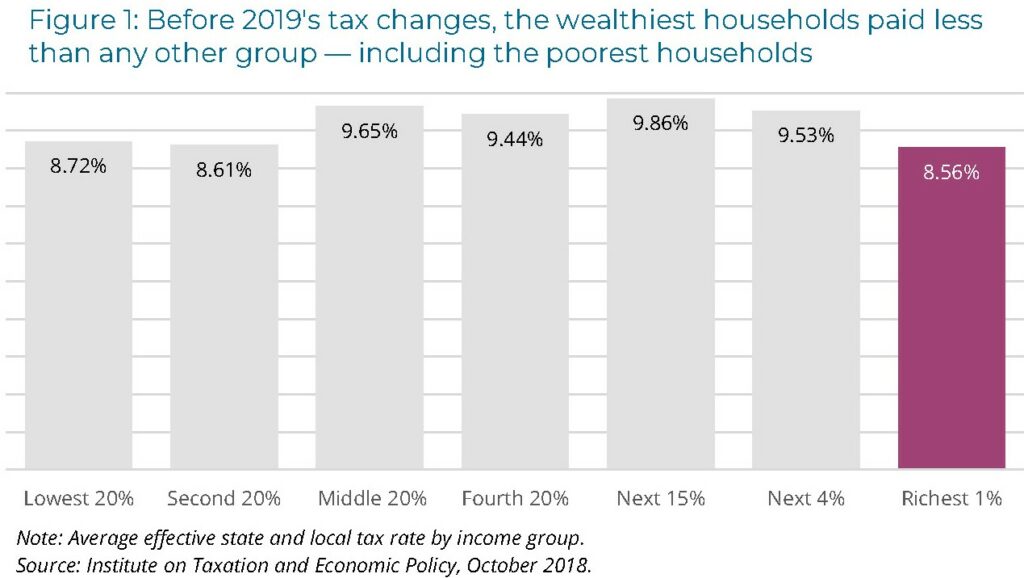

Maine Who Pays 6th Edition Itep

Maine Who Pays 6th Edition Itep

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Welcome To The City Of Bangor Maine Excise Tax Calculator

How To Fix Maine S Transportation Funding Shortfall The Maine Wire

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Historical Maine Tax Policy Information Ballotpedia

File State And Local Taxes Per Capita By Type Png Wikipedia

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Who Pays 6th Edition Itep

Maine Reaches Tax Fairness Milestone Itep

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Sales Tax Small Business Guide Truic

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation